“Should I buy now or wait for mortgage rates to drop?”

One of the biggest questions buyers are asking me right now

Let’s look at the facts and the tradeoffs of buying now or waiting. What you need to consider.

Well, let’s break it down…

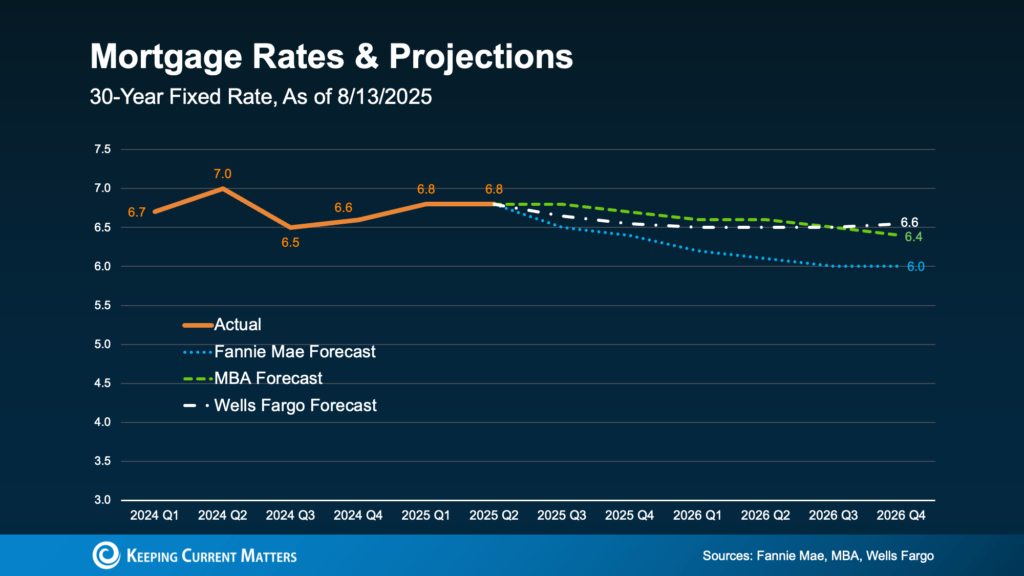

Where are Mortgage Rates Today, if You were to Buy Now

After the latest jobs report came in weaker than expected, the bond market reacted quickly — and rates dropped to 6.55%, the lowest so far this year.

That dip has many people wondering: “Is now a good time to buy a house 2025, or should I wait for mortgage rates to fall further?”

According to the latest mortgage rate forecast 2025 housing market outlook, most experts agree we won’t see a dramatic drop. Projections suggest rates will hover in the mid-to-low 6% range through 2026.

So while there may be small ups and downs, a major plunge isn’t likely anytime soon.

Now, that may not seem like a massive drop, but trust me, buyers have been waiting for any sign of movement. Even small changes like this light a fire under the market because they hint that rates might be heading lower.

But here’s the reality:

Most experts aren’t expecting rates latest forecast to drop dramatically anytime soon. Projections show rates hanging in the mid-to-low 6% range through 2026. That means, yes, we’ll see ups and downs, but no massive plunge overnight.

The Magic Number: 6%

For many buyers, the tipping point is 6%. And it’s not just psychological — it’s real math.

NAR data shows that if rates hit 6%:

5.5 million more households could afford a median-priced home

Around 550,000 buyers would jump into the market within 12–18 months

That’s a lot of pent-up demand waiting for the same moment.

Should you wait to buy a home until interest rates fall to 6%? (See Infographic)

Here’s the catch: if you’re waiting, millions of others are too.

The Tradeoff of Buying Now Instead Waiting

When rates eventually inch closer to 6%, here’s what will happen:

Competition will heat up

Inventory will shrink

Home prices will rise

Right now, buyers actually have an edge:

✅ More homes available to choose from

✅ Slower home price growth

✅ Better negotiating power with sellers

These opportunities may disappear once demand surges.

Bottom Line

So… buy a house now or wait for mortgage rates to drop?

Rates aren’t expected to hit 6% this year, but when they do, you’ll likely face bidding wars and higher prices.

If you’d rather shop with less competition, more options, and stronger negotiating leverage, the window of opportunity is open right now.

The real question is: Do you want to buy when the market is calm, or when the race is on?